Public finance statistics

General Government

In addition to the four public finance budgets, the general government sector covers also revenue and expenditure of indirect budget users and other institutional units. All reporting requirements prescribed by national and EU law are thus fulfilled, with the applied methodology ensuring the international comparability of the data.

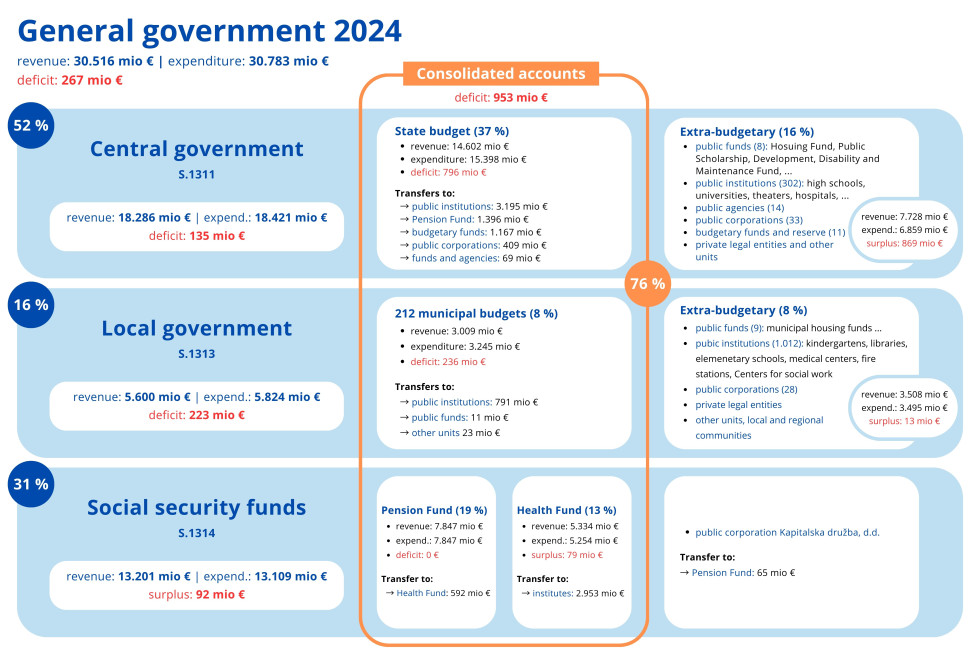

The figure presents the consolidated cash-based data of the general government sector in 2024. It includes central government, which represents more than 50 percent of the general government sector; local government, with a 16 percent share; and social security funds, covering about 30 percent of the sector. In the consolidation process, transfer flows between units are excluded in accordance with accounting rules and methodological exceptions. Each month, we monitor the realization of 76 percent of the general government sector, of which the state budget accounts for 37 percent, municipal budgets for eight percent, and the accounts of the Pension and Disability Insurance Institute and the Health Insurance Institute for 19 percent and 13 percent, respectively (the percentages are calculated on a gross basis and represent estimated shares of individual unit groups or subsectors). In addition to the four main public finance budgets, the general government sector also includes public institutions (examples: secondary schools, universities, hospitals), funds (example: the Housing Fund), agencies, corporations and other units in accordance with the European statistical standard ESA 2010 and the Standard Classification of Institutional Sectors (SKIS).

The general government sector comprises more than 2,700 units, including 186 direct budget users at the central level and 1,050 at the local level. The number of units by subsector is based on data from the Slovenian Business Register, provided by the Agency of the Republic of Slovenia for Public Legal Records and Related Services, as of the last day of the year. The Slovenian public finance system is based on the methodology of the International Monetary Fund (GFS 1986) for monitoring public finance flows (Rules on the Single Chart of Accounts), while estimates for the general government sector are prepared according to the more recent GFS 2014 methodology, which ensures international comparability.

Public finance budgets

The public finance budgets include the state budget, municipal budgets, the pension insurance fund and the health insurance fund. The largest is the state budget, representing 49 percent of total expenditure of all four public finance budgets. Next is the Pension and Disability Insurance Institute of Slovenia amounting to 25 percent, followed by the Health Insurance Institute of Slovenia with 17 percent, and the municipal budgets with 10 percent.

State budget

The state budget data show in detail the actual revenue and expenditure of the State. The revenue, of which the majority is collected from taxes, is used for financing the obligations of the State in a particular year.

Pension and Disability Insurance Institute of the Republic of Slovenia

The Pension and Disability Insurance Institute (ZPIZ) pays pensions, disability allowances and other transfers providing social security to all claimants. The Institute also pays health insurance for all pensioners. The main revenue of the Institute is from social security contributions. The transfer from the state budget also represents a large part of the revenue, as the collected social security contributions are not sufficient to cover the pensions in full.

Health Insurance Institute of the Republic of Slovenia

The Health Insurance Institute (ZZZS) covers the costs of the operation of public health institutions and the provision of healthcare services (e.g. salaries, medicinal products and medical devices). The larger part of the costs are sickness benefits. The revenue of the Institute consists mostly of health insurance contributions. Another part of the revenue is from transfers from the pension fund in the form of health insurance contributions for pensioners. In recent years the state budget resources allocated to special healthcare programmes have been increased.

Municipal budgets

Municipal budgets represent the revenue and expenditure of all 212 municipalities. The two major sources of municipalities’ revenue are income tax and property tax (such as the land rent for use of building grounds). Other important sources are capital gains, income from public utility charges, municipal fees and fines. Expenditure includes expenses for the operation of municipalities, capital expenditure, subsidies, transfers to individuals (this includes partially covered expenses for pre-school programmes and subsidies for home care) and for the operation of public institutions at the local level.

Consolidated public finance budgetary accounts

Consolidated public finance budgetary accounts include the accounts of all four public finance budgets, i.e. the state budget account, the aggregate account of municipal budgets and the accounts of the ZPIZ and ZZZS. Consolidation in the public finance budgetary accounts means that all flows from one public finance budget into another are mutually offset to prevent double capturing and artificial increase in the amount of public finance revenue and expenditure.

Regular publication of fiscal data

At the end of April 2024, as part of the comprehensive reform of fiscal rules at the European Union level, Council Directive (EU) 2024/1265 was adopted, amending Directive 2011/85/EU on the budgetary frameworks of the Member States. The new directive promotes the collection of up-to-date data and information for the general government sector and all its subsectors based on the accrual principle, in accordance with the ESA methodology (European System of National and Regional Accounts). The availability and quality of statistics compiled by the Statistical Office of the Republic of Slovenia (SURS), based on the ESA 2010 standard, are of key importance for ensuring the proper functioning of the EU's fiscal surveillance framework. Quarterly debt and deficit data are prepared by SURS. In addition, Member States are required to disclose data on contingent liabilities as well as information on the participation of general government in the capital of private and public corporations.

-

Contingent liabilities of the general government

Reports

Special data dissemination standards

The Special Data Dissemination Standard Plus (SDDS Plus) is an enhanced version of the SDDS standard, introduced by the International Monetary Fund (IMF) in 2012 to address data gaps identified during the global financial crisis. It is intended for countries with advanced statistical systems and provides more detailed and specific data for more accurate assessments of economic conditions, thereby increasing the confidence of users such as financial markets and international institutions. In accordance with the expanded standard, the Ministry of Finance voluntarily prepares and publishes fiscal data in the framework of Statement of Operations (Central Government Operations – Budget, Central Government Operations and General Government Operations), which, in line with IMF requirements, are submitted in two different formats, accompanied by methodological descriptions.

-

Central Government Operations – Budget

Reports- Central Government Operations – Budget (xlsx, 71 KB)

- Central Government Operations – Budget / sdmx (xml, 232 KB)

- Central Government Operations – Budget / Metadata (docx, 51 KB)

-

Central Government Operations

Reports- Central Government Operations (xlsx, 37 KB)

- Central Government Operations / sdmx (xml, 83 KB)

- Central Government Operations / Metadata (docx, 53 KB)

-

Quarterly General Government Operations

Reports- General Government Operations (xlsx, 37 KB)

- General Government Operations / sdmx (xml, 83 KB)

- General Government Operations / Metadata (docx, 61 KB)

-

Annual General Government Operations

Reports- General Government Operations - Annual (xlsx, 20 KB)

- General Government Operations - Annual / sdmx (xml, 23 KB)

- General Government Operations - Annual / Metadata (docx, 61 KB)