Prevention of money laundering

Money is ‘laundered’ when its real source is concealed and it has obtained all the characteristics of legitimately obtained assets. The final objective of money laundering is to incorporate ‘laundered’ money or assets into ordinary financial flows that are an integral part of lawful business activities, or to reinvest them in criminal activity.

Suspicious transactions

The issue of the expansion of organised and financial crime in connection with money laundering is becoming increasingly relevant, while the risk of various forms of terrorist financing has been increasing in recent years. Money laundering poses a serious threat to the stability and integrity of the operations of financial institutions, endangers the stability and reputation of a country’s financial sector, threatens the internal market and the competitiveness thereof, and above all leads to a long-term loss of confidence in the democratic institutions of modern society.

The aim of criminal activities is to generate unlawful material benefits. The crime of money laundering is committed by a person who, with the knowledge that money or assets were obtained through a criminal act, accepts, exchanges, holds, disposes of or uses such money or assets in a commercial activity or in some other way, as set out in the Act on the Prevention of Money Laundering and Terrorist Financing, to conceal or attempt to conceal the source of that money or assets through laundering activities (Article 245 of the Penal Code). Money is ‘laundered’ when its real source is no longer evident, and it has all the characteristics of legitimately obtained assets. The final objective of money laundering is to incorporate the laundered money or assets into the ordinary business flows that are an integral part of lawful business activities, or to reinvest them in criminal activity (existing or new).

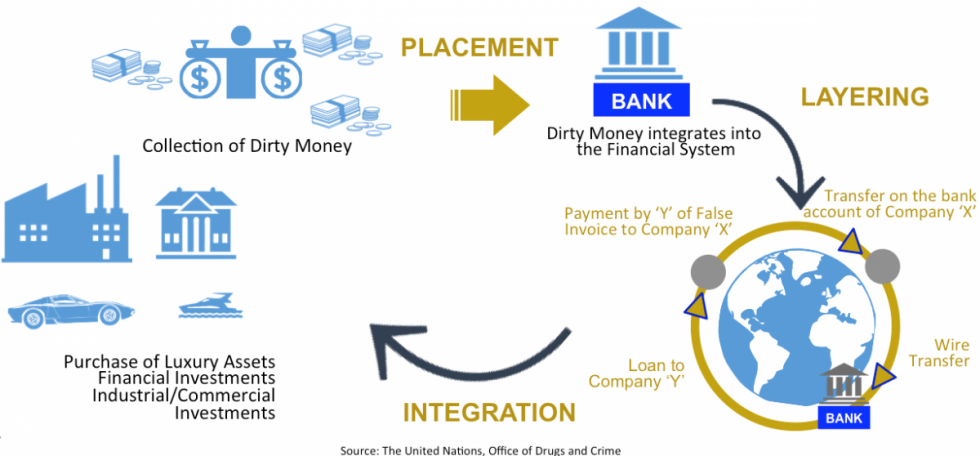

According to the valid definition of the Financial Action Task Force (FATF), which functions under the auspices of the OECD, money laundering is the process of concealing illegal assets, and is carried out in three phases:

- the placement of assetsin a country’s financial system, e.g. the transfer of cash across a border, electronic transfers abroad, conversion into another currency (banks, exchange offices, casinos, post offices, etc.);

- the concealment of the source of money or layering includes financial operations abroad via various financial institutions, the use of offshore companies, fictitious transfers and contracts, smurfing, virtual borrowing, the use of safe deposit boxes, the purchase of payment instruments with cash, the smuggling of cash, double accounting, and the resale of real estate; and

- integration or the incorporation of funds into the economy, or reinvestment in criminal activity.

The process of concealing illegal funds

A specific typology of money laundering is spoken of when we identify a pattern or series of similar processes (methods) used to conceal the unlawful source of money or other assets, including various mechanisms, techniques and instruments:

- a money laundering mechanism is an environment or system in which money laundering activities are carried out in part or in full, and primarily comprises the following groups: financial institutions (banks, savings banks, brokerage firms and leasing companies), notaries, attorneys, natural persons, legal entities, i.e. companies (domestic and foreign companies, shell companies and offshore companies), and money transfer systems (e.g. Western Union and MoneyGram);

- a money laundering instrument is the carrier of value used for money laundering activity, such as cash, cheques, securities, real estate, vehicles and vessels, and companies; and

- a money laundering technique is the way in which money laundering activities are carried out, such as cash withdrawals and deposits, the electronic transfer of funds between bank accounts (e.g. wire transfers), the use of alternative systems for transferring funds, the cross-border transfer of cash, currency exchange and smurfing.

Typology of money laundering

The Office finds that the number of reported suspicious transactions and initiatives from state and supervisory bodies, as the basis for initiating the investigation of specific matters, has been rising steadily since 2005. Accordingly, the number of matters that the Office refers to the competent authorities for further investigation (e.g. the police, prosecutor’s office and tax administration) due to the suspicion of money laundering or other crimes accompanied by notification of suspicious transactions is also on the rise. In addition to daily operational analyses, the Office has long been analysing data from reports of suspicious transactions sent to the competent authorities and from other sources with the aim of identifying potential recurring patterns or series of similar methods used to conceal the illegal source of money or other assets, including various money laundering mechanisms, instruments and techniques. Given that the number of matters referred to the competent bodies is rising every year, the set of appropriate data for performing so-called strategic analyses is also expanding.

In addition to specific forms of money laundering, we have also identified certain money laundering typologies based on strategic analyses performed. The characteristics of those typologies are presented below:

- the use of natural persons for money laundering purposes;

- the use of shell companies for money laundering purposes;

- the use of offshore companies for money laundering purposes;

- the exchange of low-value banknotes for high-value banknotes;

- the use of money transfer systems;

- the use of loans for money laundering purposes; and

- the use of the bank accounts of companies and natural persons in connection with funds and companies from neighbouring countries

Use of natural persons for money laundering purposes

We have seen the use of natural persons as a typology of money laundering for many years, most frequently as the use of the bank accounts of natural persons. The use of the bank accounts of natural persons is frequently combined with other well-known money laundering typologies, in particular the use of the bank accounts of shell companies. The main characteristic of the aforementioned typology is that the personal accounts of natural persons are primarily used to receive funds and withdraw cash, and to make transfers to other accounts, where natural persons most frequently have nothing to do with such transactions, but instead lend their name and bank account, and thus facilitate the anonymity of the actual organisers of those activities. The given purpose of transfers to the accounts of natural persons is typically false and does not reflect the actual purpose of transactions. Natural persons can also be used to launder money without a bank account. This most frequently involves cases of so-called cash couriers, whose task is to transfer cash between different countries to conceal the trail of such funds.

In connection with the use of the bank accounts of natural persons, we have also identified, as another typology, the use of the bank accounts of natural persons in connection with the precursor crime of theft through computer hacking or the use of the bank accounts of persons who use online banking services. The perpetrators of such crimes are typically not present in Slovenia, as to commit such a crime, they only need a computer and access to the internet, which they use for the unauthorised placement of software on a victim’s computer in order to retrieve the passwords the latter uses to access online banking services. When the perpetrators obtain that information, they only need a third person (‘straw man’) who ‘lends’ them their bank account, to which a perpetrator transfers funds illegally obtained from a victim’s bank account. The third party then withdraws the illegally obtained funds in the form of cash or uses money transfer systems to transfer the money to the perpetrators of the crime of theft. In this way, a third party consciously or negligently launders money for unknown perpetrators, typically for a specified fee. The source of that money is precursor crimes of theft from bank accounts. Cases have also been identified in which the perpetrators of those crimes misled third parties into believing that they are executing a legal transaction through their accounts, although that was not the case.

Use of shell companies for money laundering purposes

We have been aware of the typology of money laundering through the use of the bank accounts of shell companies for several years. It is one of the two most frequently identified money laundering typologies in Slovenia. A shell company is most often used to launder money that derives from precursor commercial crimes, such as the abuse of office or trust in a commercial activity or tax evasion. Classic criminal acts are less frequently the precursor in such cases.

Shell companies are a key link in the perpetration of the precursor crimes of tax evasion in connection with value-added tax (VAT) and the subsequent crime of money laundering. These companies are referred to as missing traders, for which the equivalent term of shell company is used in Slovenia. Shell companies typically exist only on paper, as they have no moveable property or real estate. All they have are an identification (tax) number and bank account to which the recipients of invoices (that are usually fictitious) transfer money that is then withdrawn from an account in the form of cash. Shell companies are represented by fictitious directors (straw men) who are typically persons who do not actually perform the function of legal representative and do not conclude transactions at their own discretion but at the instruction of the organisers of illegal transactions. Fictitious directors are typically from the bottom of the social ladder with a criminal past, or non-residents.

Use of offshore companies for money laundering purposes

An offshore company is a non-resident company that may not perform a commercial activity in the jurisdiction in which it was established (Seychelles, Delaware, Virgin Islands, etc.). Published on our website is a list of countries that pose increased risks in connection with money laundering and terrorist financing. There is also a list of countries that the International Monetary Fund (IMF) has recognised as so-called offshore centres. The process of establishing an offshore company abroad is relatively simple, fast and inexpensive, and can be done via the internet. Characteristic of the majority of offshore companies is the fact that the names of directors and partners are not entered in any public document or register. The same is also true for information about beneficial owners, which represents a significant obstacle in the work of law enforcement bodies. Offshore companies and their bank accounts abroad or in Slovenia are often used to perpetrate different economic crimes and the crime of money laundering. Offshore companies and their bank accounts are most frequently used to transfer funds of unlawful origin through the use of electronic banking and the concealment of beneficial owners who dispose of those funds, and to make cash withdrawals from the bank accounts of those companies.

Exchange of low-value banknotes for high-value banknotes

This typology of money laundering is primarily used by the perpetrators of crimes where illicit funds derive from recurring illegal activities, such as the trafficking of illegal drugs, stolen goods and smuggled goods, prostitution, illegal gambling, etc. This typology involves the first step in money laundering when perpetrators, themselves or via third parties, deposit illegally obtained cash on bank accounts at several branches in the form of low value banknotes (10, 20 or 50 euros) and later withdraw that money in the form of high-value banknotes.

Use of money transfer systems

Money transfer systems (e.g. Western Union and MoneyGram) can be used effectively to transfer money of illegal origin to different people all over the world. Such systems facilitate the payment of money in one place and its withdrawal somewhere else in the world, where the person for whom the money is intended has the correct password and personal document to withdraw those funds. The anonymity of the recipient of such funds (through the use of falsified documents) and an extensive network of branch offices, which facilitates the transfer of money virtually across the entire world (in some countries, bypassing strict rules that apply to financial-banking systems), are the main factors in the spread of this typology of money laundering.

Use of loans for money laundering purposes

The most widely known money laundering technique involving loans is ‘loan back’. The owner of dirty money and a person they trust conclude a loan agreement in which it is falsely stated that the latter, as lender, lends its own money to the owner of the dirty money. In this way, the loan recipient receives a document (loan agreement) regarding the source of money (a loan in this case), when in fact the transaction involves dirty money that the person has ‘lent’ to themselves or their company. Most frequently, the lender of the illegal money is an offshore company with a concealed ownership and a bank account in a foreign country. Another frequently used technique is a ‘back-to-back loan’, which involves the raising of a legal bank loan that is secured through illegal assets in the form of a deposit at the same or another bank. The perpetrator thus receives from a bank a document – loan agreement – that they can use to prove that the source of money at their disposal is ‘clean’, when in fact the loan is secured by dirty money that was previously placed at a bank, i.e. in the financial-banking system.

Use of the bank accounts of companies and natural persons in connection with funds and companies from neighbouring countries

In terms of content, this typology includes the characteristics of the use of natural persons and the use of shell companies. We identified this typology before 2009, and have seen the frequency of its use rise since that year. Its main characteristic is the use of the bank accounts of legal entities or natural persons that are used primarily to receive funds from abroad (mostly from EU countries). Those funds are then withdrawn in the form of cash or transferred to various other bank accounts. Typically used in this typology of money laundering are shell companies that are established in Slovenia in cities and towns close to national borders, while the owners and representatives of those companies are usually non-residents and less frequently Slovenian citizens. Only two types of transactions are usually executed on the accounts of shell companies: inflows of funds from abroad (primarily from EU countries) that are followed very soon by outflows of funds abroad (typically to EU countries), or cash withdrawals by authorised representatives. Natural persons usually participate in such transactions as straw men used to conceal beneficial owners and the organisers for such activities.

International cooperation

In accordance with the provisions of the Act on the Prevention of Money Laundering and Terrorist Financing, the Office exchanges data with foreign authorities responsible for the prevention of money laundering and terrorist financing. We also serve on the committees of international bodies (e.g. the European Union and Council of Europe) that deal with the detection and prevention of money laundering and terrorist financing, and participate in the evaluation of Slovenia by MONEYVAL and in the drafting and implementation of action plans.

MONEYVAL and FATF

MONEYVAL is the Council of Europe’s special Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism, whose members include the Republic of Slovenia. MONEYVAL carries out periodic evaluations of its Member States. The basis of those evaluations are the standards of the FATF (Financial Action Task Force) for the prevention of money laundering and terrorist financing and the associated methodology. The fifth round of the evaluation of the Republic of Slovenia was carried out in 2016. The report on the evaluation of Slovenia was adopted at the 53rd plenary session of MONEYVAL in May 2017.

Council of Europe Convention no. 198 on Laundering, Search, Seizure and Confiscation of the Proceeds from Crime and on the Financing of Terrorism

The Office has certain responsibilities based on Council of Europe Convention no. 198 on Laundering, Search, Seizure and Confiscation of the Proceeds from Crime and on the Financing of Terrorism (Warsaw Convention), which entered into force in 1 August 2010. Under that convention, the Office is the central body that handles all requests relating to money laundering, and the detection, seizure and confiscation of material benefits obtained through the crimes of money laundering and terrorist financing.

International Egmont Group

The Office is a founding member of the international Egmont Group, established in 1995, which brings together similar bodies (Financial Intelligence Units or FIUs) that are involved in the prevention and detection of money laundering and, in recent years, the prevention and detection of terrorist financing. The Egmont Group, which was transformed from an informal to a formal community in 2008, comprised 159 offices from around the world at the end of November 2018.

Exchange of data with related bodies

The Office may exchange data with similar bodies through the special Egmont Secure Web (ESW) computer network, which is only accessible by members of the Egmont Group. The administrator of the aforementioned network is the US Financial Crimes Enforcement Network (FinCEN). Data can also be exchanged with similar bodies via the FIU.net computer network, which only brings together the offices of EU Member States.

Memorandum of understanding on data exchange

The Office signed a bilateral memorandum of understanding on data exchange with 50 offices from the following countries, until 10 December 2020, inclusive: United States of America, Belgium, Italy, Croatia, Czech Republic, Romania, Slovakia, Cyprus, Bulgaria, Latvia, Lithuania, North Macedonia, Monaco, Albania, Poland, Australia, Ukraine, Serbia, Estonia, Israel, Russia, Montenegro, Georgia, Canada, Chile, Bosnia and Herzegovina, San Marino, the Dutch Antilles, Moldova, Malta, Kosovo, Aruba, Honduras, Iran, Mongolia, Saudi Arabia, Sri Lanka, the Vatican, Japan, Panama, Liechtenstein, Saint Marten, China, Norway, United Kingdom, Portugal, Greece, Maldives, Guatemala, South Africa, and Taiwan.

Supranational risk assessment

The European Commission drafted a supranational risk assessment report in connection with the risks of money laundering and terrorist financing that affect the internal market and that concern cross-border activities. The risks of money laundering and terrorist financing that the EU could face were analysed in that report, while the comprehensive handling of those risks was also proposed.

National risk assessment

Based on the first recommendation of the FATF regarding the prevention of money laundering and terrorist financing, countries must implement a national risk assessment. Based on an analysis of several sources of data, they must define areas of increased risk for money laundering and terrorist financing, verify whether their system for preventing money laundering and terrorist financing take sufficient account of that risk, and demand that financial and non-financial institutions and independent non-financial activities and professions identify and assess risk, and define measures for the mitigation thereof.

Pursuant to the first paragraph of Article 13 of the APMLTF-2, the Republic of Slovenia must carry out a national risk assessment for money laundering and terrorist financing, and update that assessment at a minimum every four years.

Obliged persons

The obliged persons who must implement measures to detect and prevent money laundering and terrorist financing are set out in Article 4 of the Prevention of Money Laundering and Terrorist Financing Act (APMLTF-2).

Obliged persons must, in the performance of their activities, carry out the tasks set out in the APMLTF-2 and in regulations adopted on the basis thereof for the purpose of detecting and preventing money laundering and terrorist financing.

Those tasks are as follows:

- drafting of an assessment of the risk of money laundering and terrorist financing,

- establishment of policies, controls and procedures for the effective mitigation and management of risks in connection with money laundering and terrorist financing,

- customer due diligence,

- reporting the prescribed and required data and sending documentation to the Office for Money Laundering Prevention of the Republic of Slovenia,

- appointment of a compliance officer and deputy officers, and ensuring the requisite work conditions,

- ensuring the regular professional training of employees and the performance of regular internal controls over the performance of tasks pursuant to the APMLTF-2,

- drafting a list of indicators for identifying customers and transactions in connection with which there are grounds to suspect money laundering or terrorist financing,

- ensuring the protection and retention of data and the management of records prescribed under the APMLTF-2,

- implementation of policies and procedures at the group level, and measures to detect and prevent money laundering and terrorist financing in own branches and at subsidiaries under majority ownership in member states and in third countries,

- performance of other tasks and duties pursuant to the provisions of the APMLTF-2 and regulations adopted on the basis thereof.